- #Paying bills in quickbooks software

- #Paying bills in quickbooks code

- #Paying bills in quickbooks free

#Paying bills in quickbooks software

Thanks and hope you are staying healthy and safe.Every business needs accounting software to handle their accounting needs, such as accounts receivable, accounts payable, client and vendor management, inventory management, and time management. In addition this would allow for tracking discounts should we wish to do so.Īm I on the right track here with the above?

#Paying bills in quickbooks code

*for #2 - for our particular company this item code could be easily be set up and used since any discounted purchases would be expensed to the same GL account. If the above statement is correct - then I see that accounting for the discount can be tracked in several ways in QB Online: 1) Create a vendor credit memo and apply at time of payment using the same product/service code as the original invoice 2) Set up a product / service line item assigned to the appropriate / corresponding account number for vendor expense and enter onto invoice as an additional "negative" amount to reduce the total invoice appropriately 3) Reduce the amount of the invoice entered at the time of entry by the discount. It does not make sense to me that the discount would be accounted for directly as income Yes it increases income but in the form of the reduction of the appropriate expense - correct? I can see there are several ways to set up early payment discounts for vendors.

#Paying bills in quickbooks free

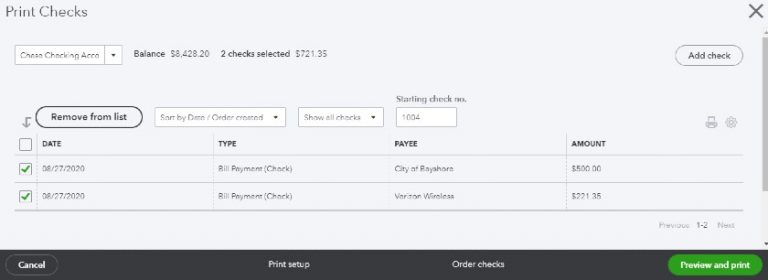

If you have any other questions, feel free to comment below. In case you need tips and related articles in the future, visit our QuickBooks Community help website for reference: QBO Self-help. He/she could guide you which option to take based on your recording practice and business needs. However, I still encourage seeking help with your accountant. Please refer to the screenshot below.Īlso, I want to let you know when creating a vendor credit will automatically reduce the COGS. Once done, you can now apply the vendor credit to the bill as a discount. I'm here to assist you with this.įirst off, we'll need to create a vendor credit using the inventory item. As mentioned by my colleague GarlynGay, in QBO, you'll need to create a vendor credit so the system will allow you to apply it to the bill payments as a discount. Let me help you ease your confusion, an income account that was discussed above is for QuickBooks Desktop users. Let me know if this works out for you, and if I can be of additional help. See resolve data damage on your company file for more information.

This fix data damage on the company file. If you’re still experiencing the same problem even after ensuring the set up is correct, let's run the Verify and Rebuild Tool. Go to the Lists menu and select Customers & Vendor Profile Lists, then choose Terms List.If this is not the case on your end, you need to review the Terms List and check that they are all defined correctly. I chose 1% 10th Net 30 as the Payment Term and the Discount Date box fills out automatically. I created a bill using my sample company file. I’m here to share some information about the Discount Date box.

0 kommentar(er)

0 kommentar(er)